Warren Buffett’s Best Investing Advice: ‘Some Things Just Take Time’

Written by

Gabrielle Olya

Written by

Gabrielle Olya

Edited by

Amen Oyiboke

Edited by

Amen Oyiboke

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 YearsHelping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

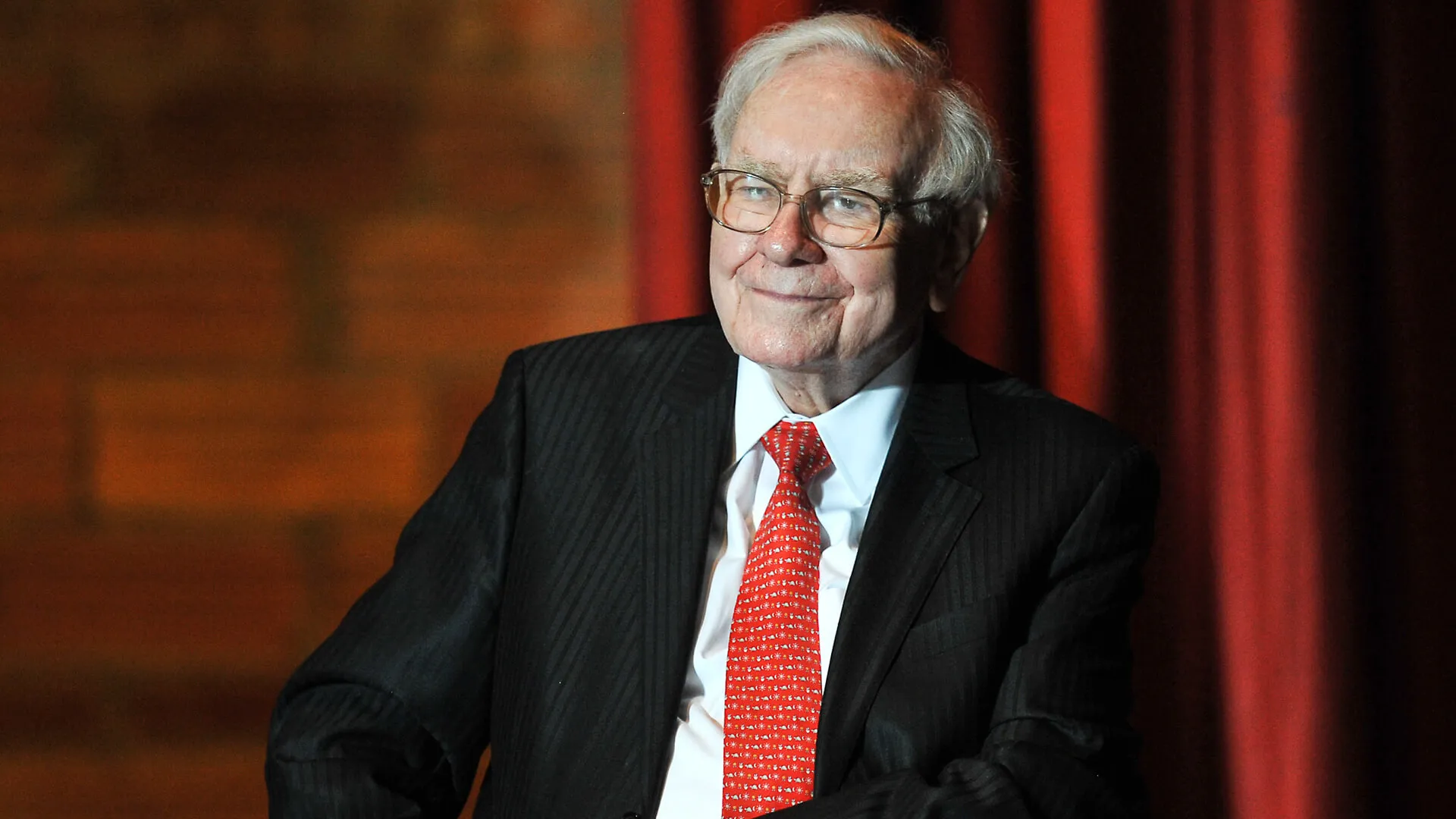

Warren Buffett is one of the most successful investors of all time, and he credits his success to sticking to a few basic investing principles.

Here’s a look at some of the “Oracle of Omaha’s” tried-and-true investing tips.

Invest in Low-Cost Index Funds

To build up retirement savings, Buffett swears by one simple tip.

“Consistently buy an S&P 500 low-cost index fund,” he told CNBC in 2017. “I think it’s the thing that makes the most sense practically all of the time.”

Stay the Course

As the market fluctuates, it’s easy to panic and be tempted to sell your holdings during the downswings. But Buffett advises against this.

“Keep buying through thick and thin, and especially through thin,” he told CNBC. “The temptation when you see bad headlines in newspapers is to say, ‘Well, maybe I should skip a year or something.’ Just keep buying. American business is going to do fine over time, so you know the investment universe is going to do very well.”

Don’t Bet on Individual Stocks

Buffett advises against the practice of stock picking.

“The trick is not to pick the right company — the trick is to essentially buy all the big companies through the S&P 500 and to do it consistently, and to do it in a very, very low-cost way,” he told CNBC. “You do not want to ever get the impression that you can pick stocks.”

Pay Attention to Fees

Buffett preaches the advantages of low-cost index funds and warns investors to pay attention to fees when choosing where to invest.

“Costs really matter in investments,” Buffett told CNBC. “If returns are going to be 7 or 8% and you’re paying 1% for fees, that makes an enormous difference in how much money you’re going to have in retirement.”

He doesn’t believe paying high management fees is worth it.

“The record shows that the unmanaged index fund is going to do quite well over time, and active investment as a group can’t beat it,” Buffett said.

Start Early

If you haven’t started investing, start now. Buffett believes the earlier you can get in the game, the better.

“Start early,” he said at the 1999 Berkshire Hathaway annual shareholders’ meeting, CNBC reported. “I started building this little snowball at the top of a very long hill. The trick to (having) a very long hill is either starting very young or living to be very old.”

Do Your Own Research

During the 1999 shareholders’ meeting, Buffett advised investors to “learn what you know and what you don’t.” And when you do learn about what you’re investing in and feel confident about it, don’t let other people’s opinions dissuade you from doing what you believe is best.

“You can’t look around for people to agree with you,” Buffett said, according to CNBC. “You can’t look around for people to even know what you’re talking about.”

Keep a Long-Term View

In his 2014 letter to Berkshire Hathaway shareholders, Buffett explained the importance of keeping a long-term view, especially during market downswings.

“For the great majority of investors, however, who can — and should — invest with a multi-decade horizon, quotational declines are unimportant,” he wrote. “Their focus should remain fixed on attaining significant gains in purchasing power over their investing lifetime.”

Invest in Yourself

Especially during times of inflation, Buffett says you are your best investment.

“The best thing you can do is to be exceptionally good at something,” he said at the 2022 Berkshire Hathaway annual shareholders’ meeting, according to CNBC. “Whatever abilities you have can’t be taken away from you. They can’t actually be inflated away from you. The best investment by far is anything that develops yourself, and it’s not taxed at all.”

More From GOBankingRates

Share This Article:

Related Content

I'm A Financial Advisor: 5 Investments Every Gen Zer Should Make Before Turning 30

April 23, 2024

4 min Read

Tony Robbins: Watch Out for These 3 Red Flags in Your Investment Portfolio

April 22, 2024

4 min Read

Billionaire Investor Steve Schwarzman: 5 Investing Rules Everyone Should Follow

April 22, 2024

4 min Read

TikTok's Humphrey Yang Says These 10 Investing Choices Are Killing Your Returns

April 19, 2024

4 min Read

What is a Shareholder Meeting? Here's What Investors Should Know and How to Attend

April 19, 2024

4 min Read

Here's Every Stock in Warren Buffett's Portfolio: What To Know About All 45 Picks

April 19, 2024

4 min Read

Warren Buffett vs. Cathie Wood: Here's the Difference Between Their Investment Strategies

April 19, 2024

4 min Read

Berkshire Hathaway Class A and Class B Shares: What To Know Before Investing

April 19, 2024

4 min Read

Sign Up For Our Free Newsletter!

Get advice on achieving your financial goals and stay up to date on the day's top financial stories.

By clicking the 'Subscribe Now' button, you agree to our Terms of Use and Privacy Policy. You can click on the 'unsubscribe' link in the email at anytime.

Thank you for signing up!

Sending you timely financial stories that you can bank on.

Sign up for our daily newsletter for the latest financial news and trending topics.

For our full Privacy Policy, click here.