3K+

Twitter Followers

5

Number of Books Published

1998-2003

‘Right on the Money’ Host

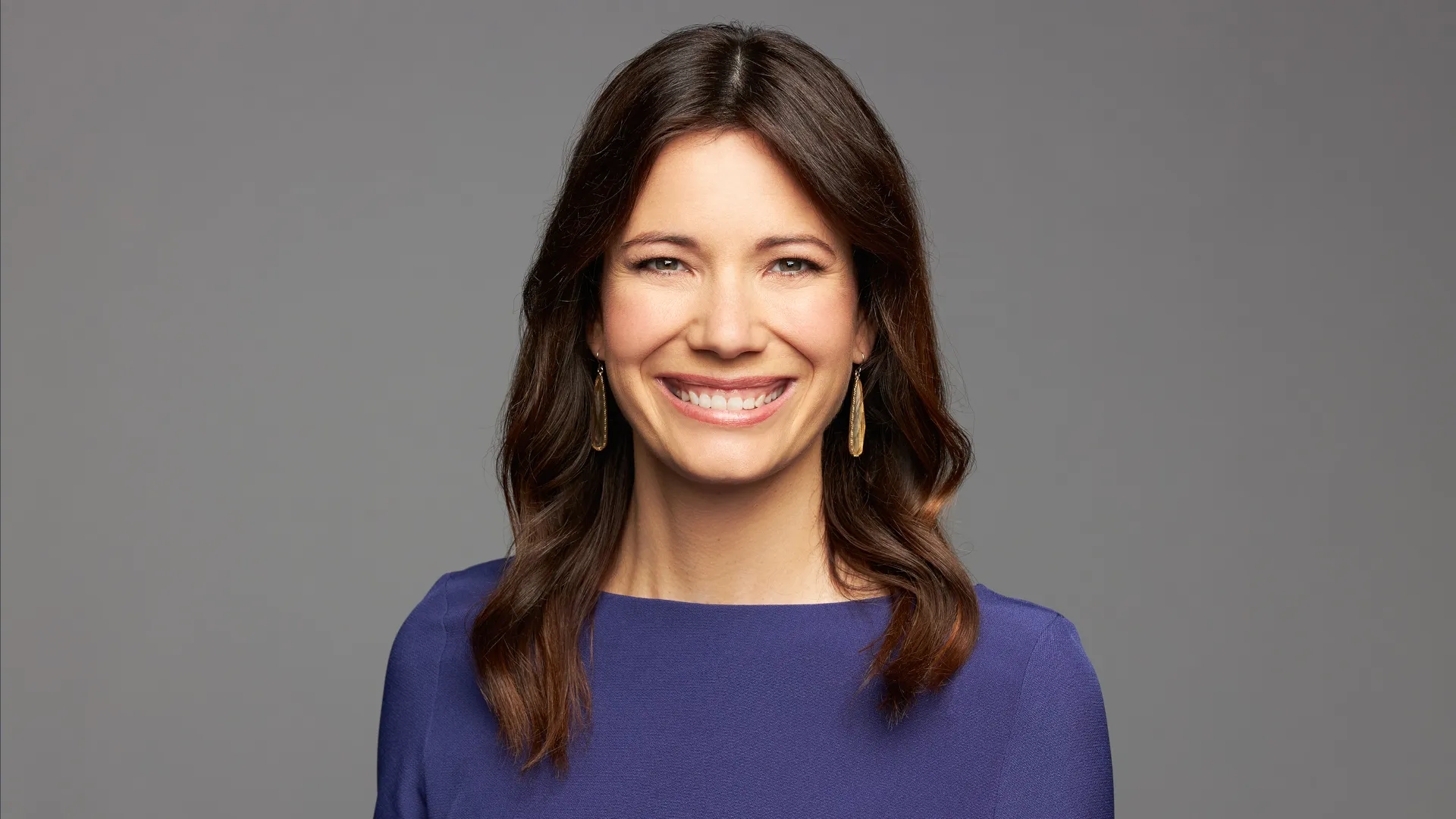

Biography:

Chris Farrell is an economics and personal finance expert who pens the “Your Money” column for the Star Tribune. He is also a senior economics contributor at the nationally syndicated public radio show “Marketplace,” a host and economics commentator for Minnesota Public Radio, and a columnist for PBS Next Avenue.

Farrell has published five books on personal finance and the economy including “Purpose and a Paycheck: Finding Meaning, Money, and Happiness in the Second Half of Life.”

A well-seasoned journalist, Farrell has previously written for Bloomberg Businessweek, served as an economics correspondent for American Public Media’s long-form documentary unit, and hosted the nationally syndicated personal finance program “Right on the Money.”

Prior to becoming a journalist, Farrell spent four years working as a merchant seaman.

Why He’s a Top Money Expert:

Farrell is a key columnist for the Star Tribune, the No. 10 newspaper in the U.S.

Q&A:

What do most people not know about investing that you wish they knew?

First, that the essence of investing is uncertainty. How confident are you about the trajectory of the stock market over the coming year, let alone the next 10 years?

Knowing that surprise is inevitable with markets, putting money into a portfolio that matches the performance of an index like the S&P 500 is cheap, simple and savvy. Investors in equity index funds consistently outperform most professional stock pickers. Among the biggest attractions of broad-based index funds is very low fees compared to actively managed funds. You’re not paying money managers to beat the market which, experience and market history show, is difficult to do over time.

Second, diversification pays, especially considering that investors can’t escape uncertainty about future asset returns. As Don Quixote de la Mancha put it: “Tis the part of a wise man to keep himself today for tomorrow, and not venture all his eggs in one basket.”

What should everyone be doing to build their wealth, no matter how much money they currently have?

The bedrock insights of personal finance include: Save often, keep fees low, prepare for the unexpected, invest in learning and create a margin of financial safety. These ideas have been honed over centuries of dealing with financial uncertainty and upheaval. The principles seem easy enough, but they’re often hard to follow in practice. Life is complicated and messy.

That said, the best way to get your financial bearings in uncertain times is to ignore what you can’t control, like the direction of the stock market and the economy. Put away all the forecasts. Instead, focus on what you can control. That starts with creating a budget no matter what you earn. You’ll learn where your money is going and where you might need to make some adjustments. From that practical base of knowledge, you can make plans to get to where you want to be despite economic and market uncertainty.

I would also expand the definition of investment. Too much of the conversation revolves around the markets. Nothing wrong with investing in stocks, real estate and fixed-income securities, but your valuable asset in good times and bad is your network — family, friends, good colleagues and people you respect. Invest in your network. They’ll help you find a job if you get laid off and they’ll work with you to advance your career. Investments in job skills and education can also pay off big.

Top Offers

Money Advice From Experts