39.8K+

Twitter Followers

8.2K+

Instagram Followers

4

Books Published

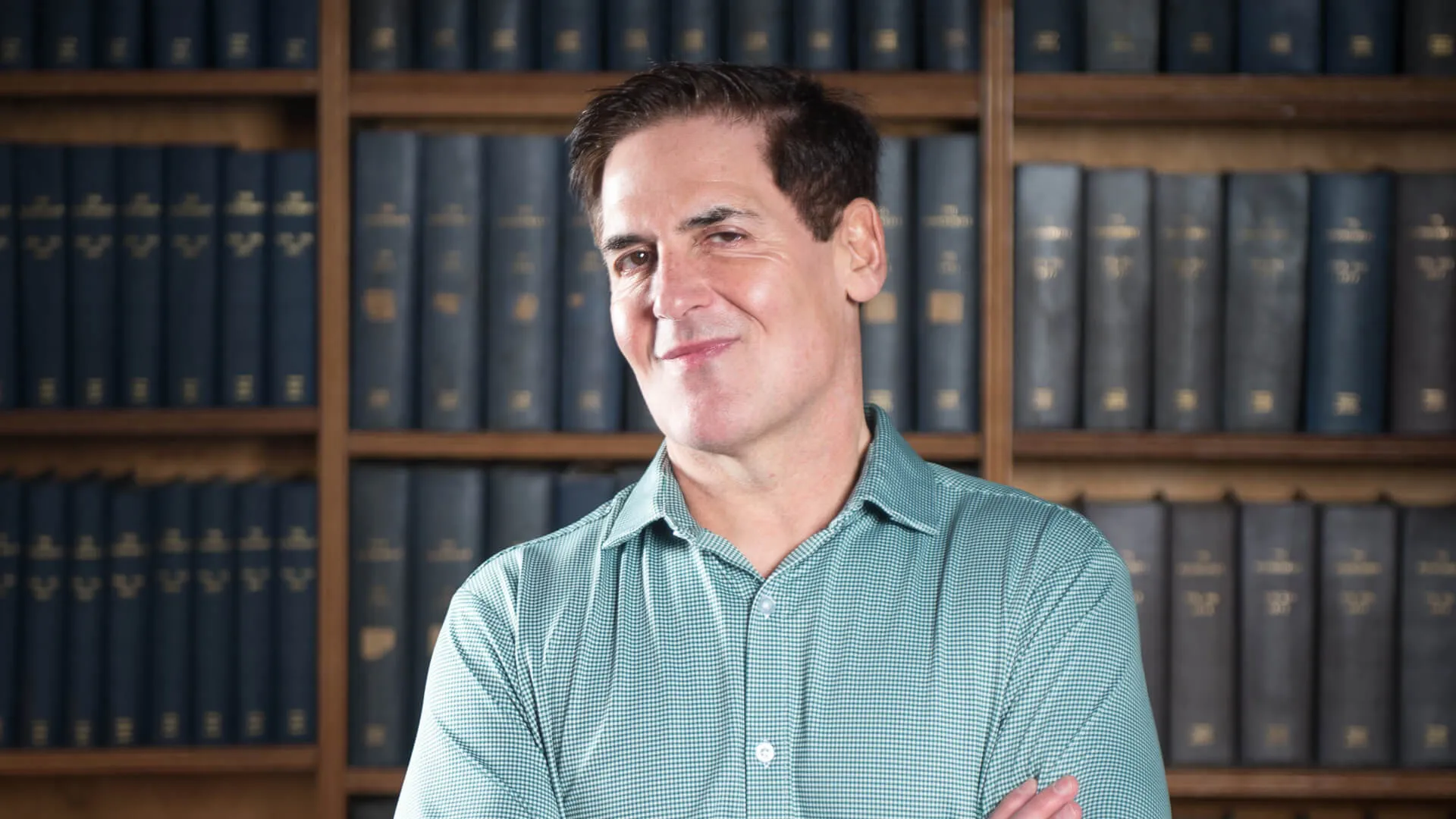

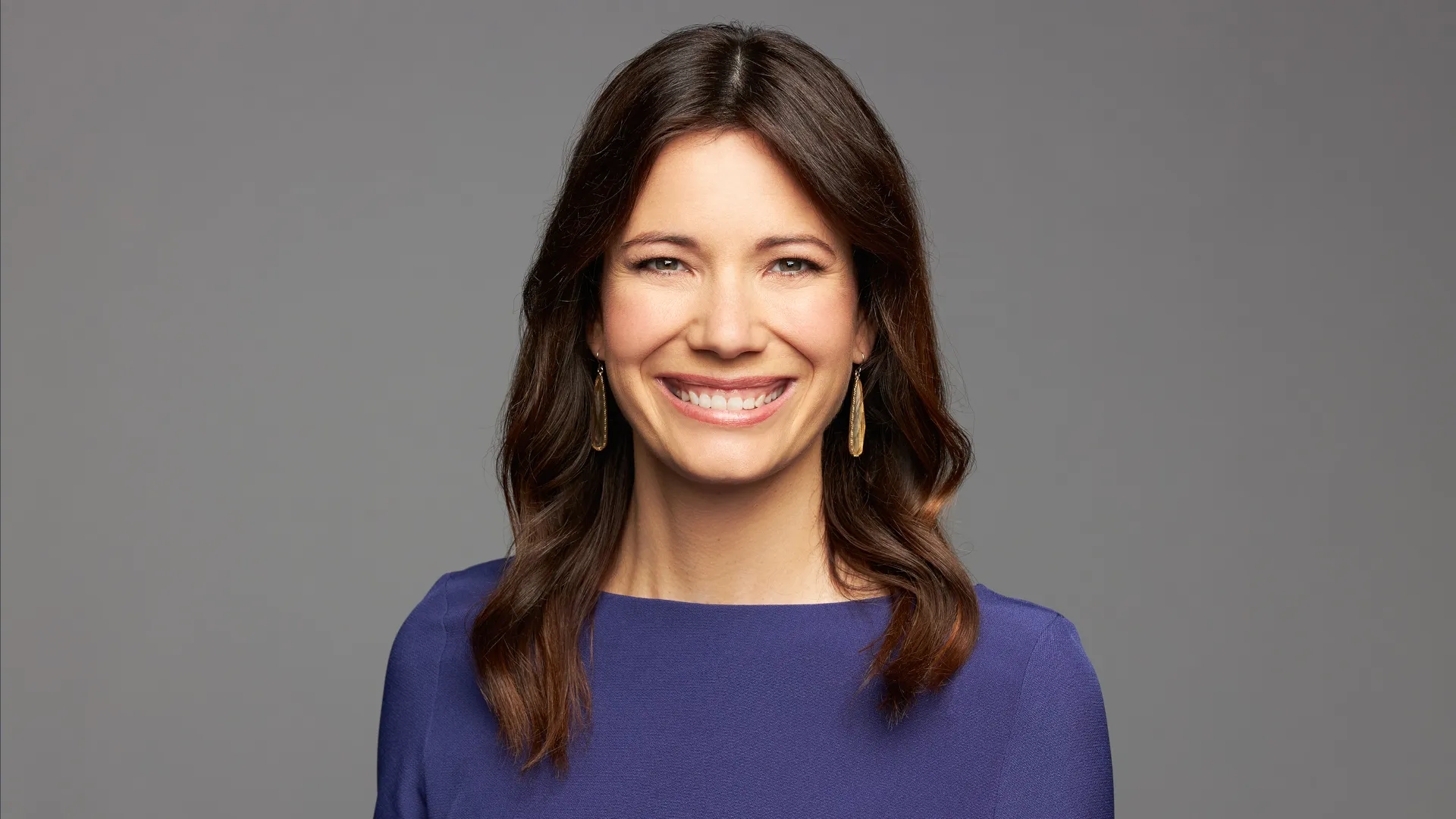

Biography:

Singletary is a columnist for the Washington Post. She writes a nationally syndicated personal finance column and has written four personal finance books.

She has won two Gerald Loeb Awards, the first for her series “Sincerely, Michelle” in 2021 and the second for lifetime achievement in 2022.

Why She’s a Top Money Expert:

Singletary has a wide audience for her award-winning personal finance advice.

Q&A:

What’s your best tip for fighting the effects of inflation?

With any looming financial crisis, you have to go back to your numbers. And I mean the real figures, not the ones you hold in your head thinking, “I don’t really eat out that much.” Or “I only buy what’s necessary with my credit card.”

Pull your bank account statements for the last six months to a year. Comb through it to find every single area where you can cut. Do this because some things you can’t control, such as the cost of housing unless you move, or how much your eggs, milk, and bread cost — even if you shop as wisely as possible. Question every single expenditure by first being crystal clear on the money coming in and out of your household.

What’s the biggest mistake people make when it comes to money, and what should they do instead?

Budget is not a bad word. Your budget is not your enemy, yet that is the biggest mistake people make. They fear the figures and that, in turn, keeps them uninformed about their true financial situation. The other mistake is using debt to elevate their lifestyle. Many Americans are living the American Dream using other people’s money. Debt destroys your cash flow, especially in hard economic times.

How can people be prepared financially for a potential recession?

Your best defense when a recession is coming is to cut costs and build up your cash reserves. Both strategies will serve you well if you have a drop in your income. I understand the advice seems simple, but so many consumers are not doing well managing the money they have.

Top Offers

Money Advice From Experts