154K+

Instagram Followers

7.8K+

Twitter Followers

176K+

Total Audience Reach (Twitter, Instagram, YouTube and TikTok)

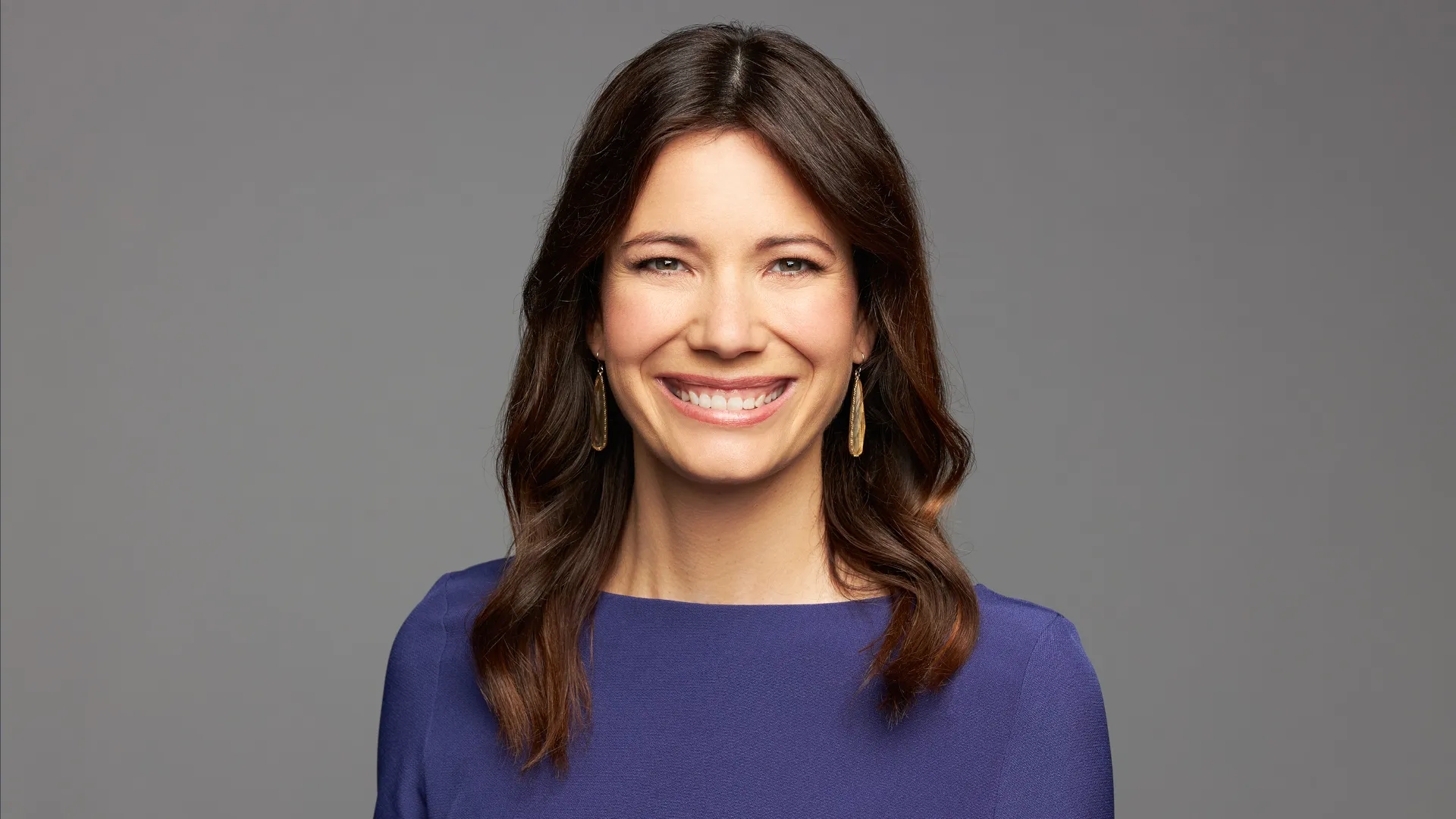

Biography:

David Greene is the host of the “BiggerPockets Real Estate Podcast,” which boasts over 14,000 five-star reviews.

He is also the author of the books “Long Distance Real Estate Investing,” “Buy, Rehab, Rent, Refinance, Repeat” and “Top Producer Trilogy: Sold, Skill and Scale.” A nationally recognized authority on real estate, Greene has made appearances on CNN, Forbes, HGTV and more.

Greene helms The David Greene Team, a top-producing real estate company at Keller Williams. He also owns the mortgage company The One Brokerage and runs Spartan League, a community of individuals interested in real estate investing and finance. In addition, Greene shares his knowledge through his weekly textletter and Discord server DG’s World.

Why He’s a Top Money Expert:

Greene’s “BiggerPockets Real Estate Podcast” is a top-rated show in its category.

Q&A:

What’s the one piece of money advice you wish everyone would follow?

Track your money and where it’s going. Every dollar should have a job. Money earned without a plan for how it will be used will inevitably be wasted. You can make this simple by creating a budget. Knowing how much of your money is allotted towards housing, gas, car payments, food, entertainment, etc. will keep you aware of where your money is going. This is the first step towards ensuring it’s going towards the plan you have for how you want your life to look.

What’s the most important thing to do to build wealth?

Take a three-pillar approach. Focus on saving money through budgeting, making money through starting a business or getting promoted, and investing money through financial education. You need all three pillars to build wealth — one or two isn’t enough.

What’s your best tip for fighting the impacts of inflation?

Invest your money in appreciating assets like real estate. Most things take your money, very few will give it back and even fewer will give it back at a rate higher than inflation.

What’s the biggest mistake people make when it comes to money and what should they do instead?

People look at money the wrong way. They see it as a means of gratifying their immediate desires — what they want to wear, eat, drive, etc. Our immediate desires, like wanting to look good in front of other people, are rarely in our best interest. Instead, it’s better to look at money as a means of energy storage. The eight hours you worked in the warehouse were an expenditure of your energy, and the $200 you earned doing it is where you store that energy. When you use that money to buy a pair of shoes, you’re storing the energy in the shoes, where it will be significantly decreased. Store as much of your energy in places that go up in value, like investments, not down, like consumer purchases.

Top Offers

Money Advice From Experts