10

New York Times Bestsellers

1.3M+

Twitter Followers

124K+

Instagram Followers

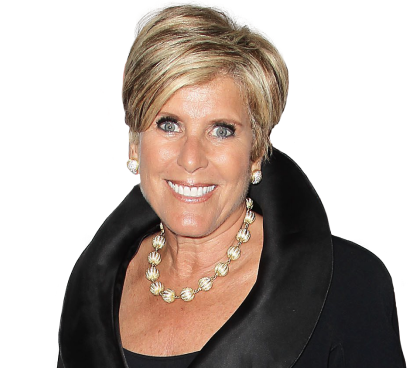

Biography:

Suze Orman is one of America’s most recognized experts on personal finance. She is the author of 10 consecutive New York Times bestsellers, a two-time Emmy Award-winning television host and is considered one of the top motivational speakers in the world.

Orman is currently the host of the “Women & Money” podcast, which is proudly sponsored by Alliant Credit Union. She is also the co-founder of SecureSave, an employer-sponsored program that adds emergency savings accounts to their benefits for employees.

Additionally, Orman serves as a personal finance educator for the United States Army and Army Reserve, and is a special advocate for the National Domestic Violence Hotline to help women who have suffered financial abuse.

Orman was the host of “The Suze Orman Show” on CNBC for 13 years. She has received eight Gracie Awards, which recognize the nation’s best radio, television and cable programming by, for and about women. She was twice named to the Time 100, has ranked among the World’s 100 Most Powerful Women by Forbes and was named one of the most powerful women in finance by Barron’s.

Why She’s a Top Money Expert:

Orman’s podcast serves as a financial guide for women in all stages of life. Each week, she shares her own personal stories and answers listener questions in a way that’s both entertaining and empowering.

Q&A:

What’s your best tip for fighting the impacts of inflation?

Inflation is something that is starting to come down; the new financial problem child on the block is high interest rates. Combine the closure of Silicon Valley Bank, etc. and the increase of the Fed funds rate — lenders do not really want to lend right now. So you can have a great FICO score and still pay really high interest rates on car loans, credit cards, mortgages, HELOCs and small business [loans]. We are now faced with another equally difficult economic environment.

To deal with this current situation, try to postpone anything that requires financing right now — pay off HELOCs and credit cards if you can, and live below your means but within your needs.

What’s the one piece of money advice you wish everyone would follow?

You will never be powerful in life until you are powerful over your own money — how you think about it, how you feel about it and how you invest it. Before we can get control of our finances, we must get control of our attitudes about money.

Managing money is far more than a matter of balancing our checkbooks or picking investments. Many of us know what we ought to be doing with our money, yet often don’t do it. People need to really evaluate their relationship with money so they can break through the barriers that hold them back — really evaluate why you keep spending money on things you can’t afford.

Too many experts teach that getting out of debt is the first step to financial success or freedom. I disagree. I have helped people get out of debt, only to have them six months later be right back in debt and filing for bankruptcy. You have to find out why you’re spending money you don’t have. Otherwise, you will end up right back in debt.

What’s the biggest mistake people make when it comes to money, and what should they do instead?

Nobody is going to care about your money more than you do, so don’t give it to someone else to manage. How your money is invested, spent and saved impacts you more than anyone else. With so much on the line, it makes no sense to not be engaged and on top of your finances.

I learned this lesson early on in the 1980s. When friends gave me $52,000 to open my own restaurant, I gave it to a financial advisor at a major firm to invest, thinking I was doing the smart thing, to only end up having him quickly lose it all and leaving me with nothing.

Top Offers

Money Advice From Experts

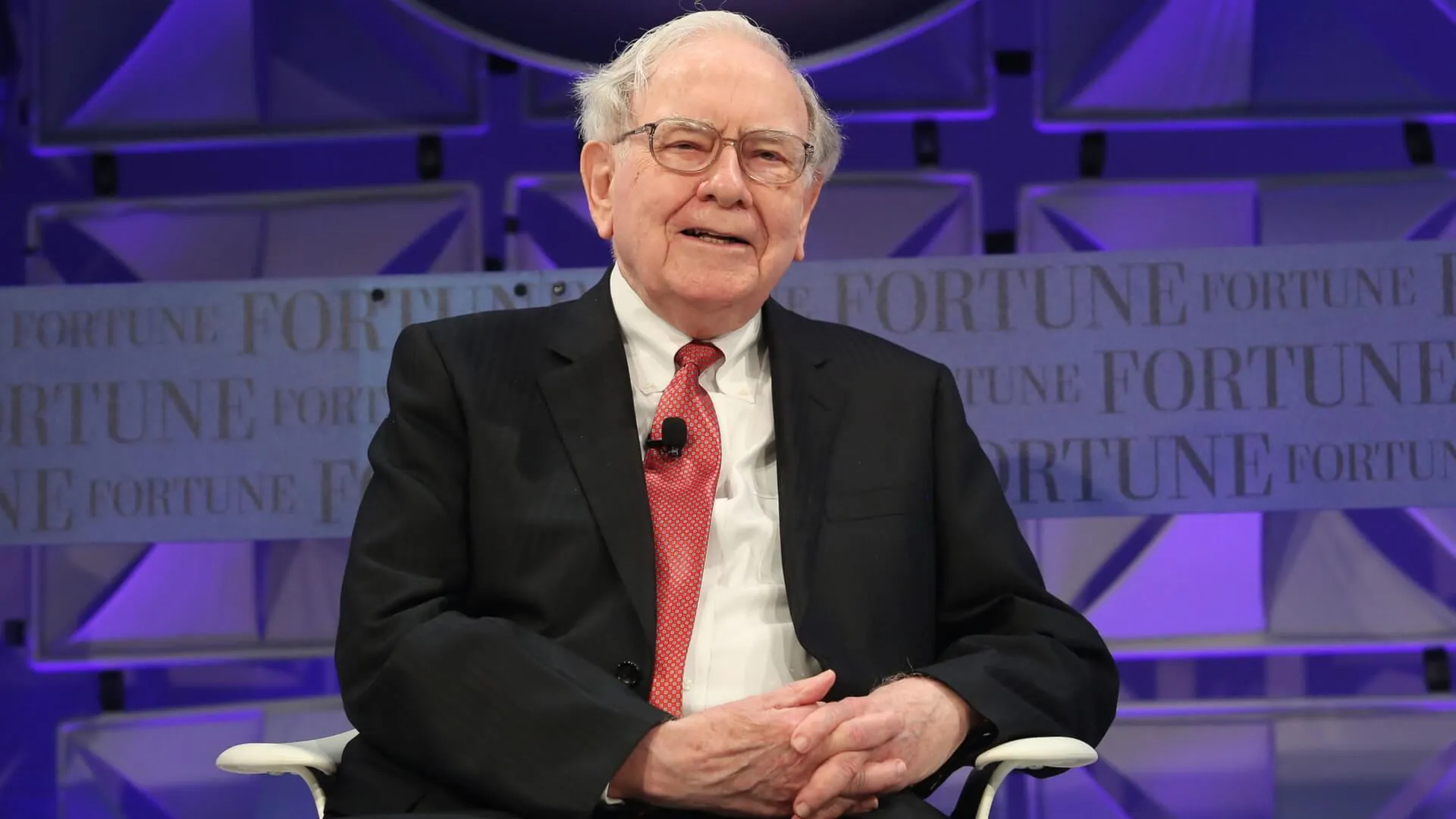

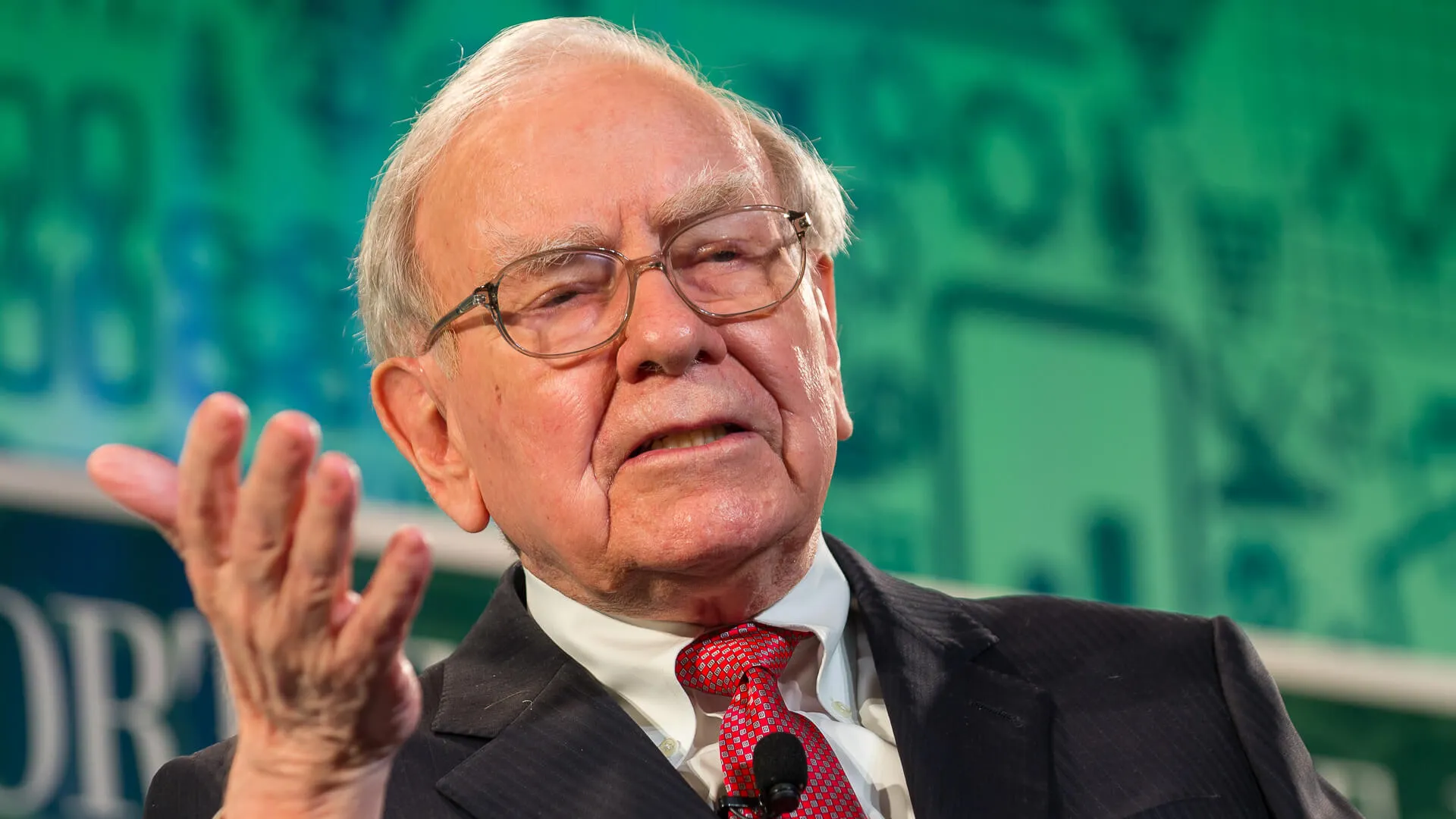

Warren Buffett, Jim Cramer and Other Money Experts Weigh in on How To Set Yourself Up for Retirement