20M+

Views ‘Going From Broke’ Received During Her Season

1

Webby Award

2014

Year Money & Mimosas Launched

Biography:

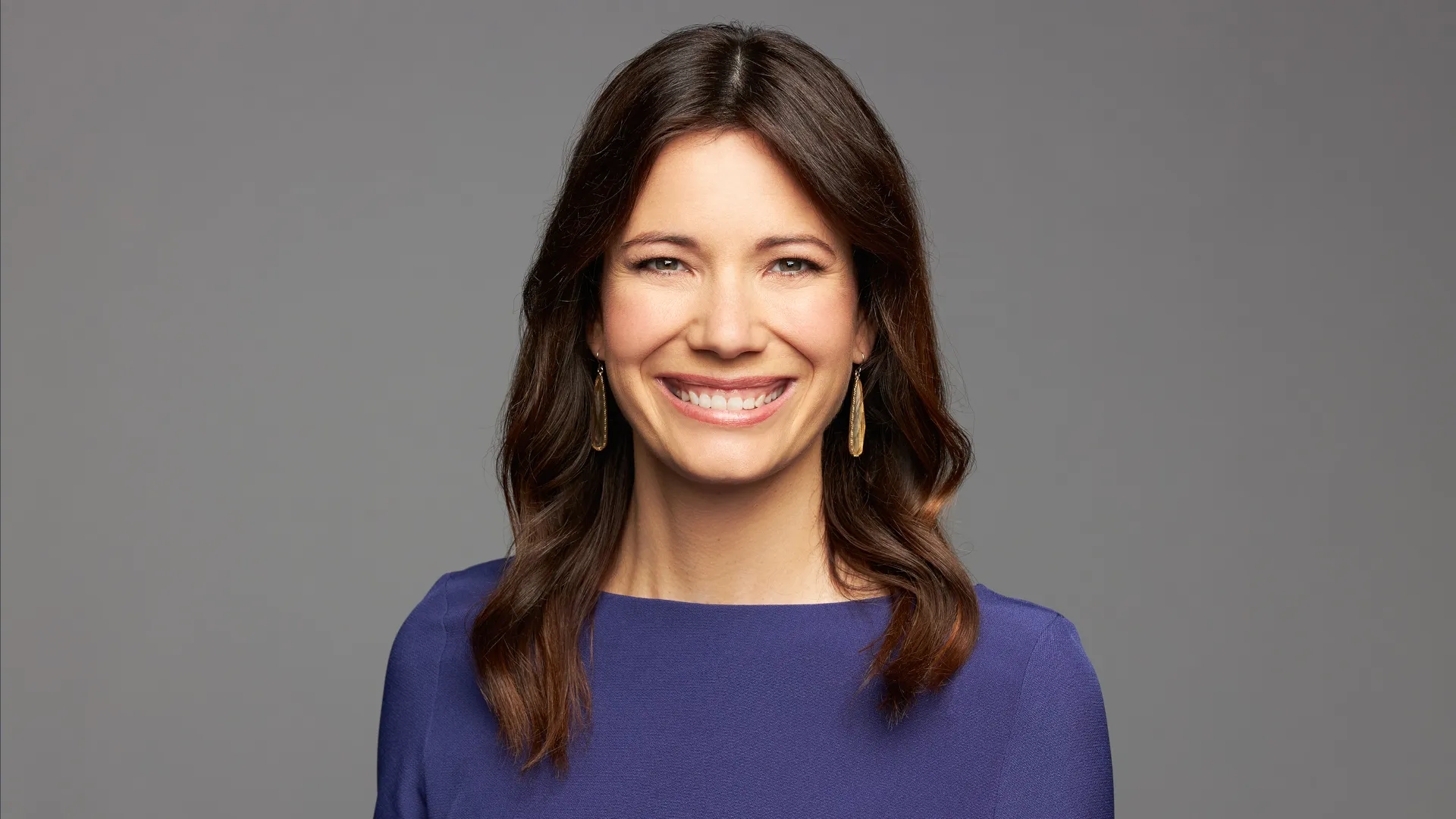

Danetha Doe is the founder of the personal finance blog Money & Mimosas, where she hopes to “spread hope, peace and abundance.” She has previously served as a chief economist and was an NFL cheerleader.

Doe started her blog in 2014 as a way to have more creative freedom in her career and is now a top-cited money expert, appearing in news outlets that include Fortune, Time, NBC and the Wall Street Journal.

Why She’s a Top Money Expert:

Doe’s blog appeals to women of all ages and walks of life, and offers them practical money advice for whatever phase they are in.

Q&A:

What do most people not know about investing that you wish they knew?

I wish people knew that their investments can have a positive or negative impact on the planet. For example, most 401(k) plans are invested in fossil fuels and are harming the planet. However, there are some retirement plans that do not. Whether you have $100 or $1 million to invest, you have an opportunity to be an investor that builds wealth and makes a positive difference.

What should everyone be doing to build their wealth, no matter how much money they currently have?

I believe everyone should be investing in themselves to build their wealth. You are your No. 1 investment. Whether it’s signing up for a personal finance workshop or a gym membership, investing in you will always pay the best dividends.

What should investors be focusing on in 2023 to make the most of their money?

I believe investors should focus on alternative investments to diversify their portfolios in 2023. This can be equity crowdfunding, international stocks or other opportunities.

Top Offers

Money Advice From Experts