368K+

Instagram Followers

141K+

YouTube Subscribers

CFEI

Certifications

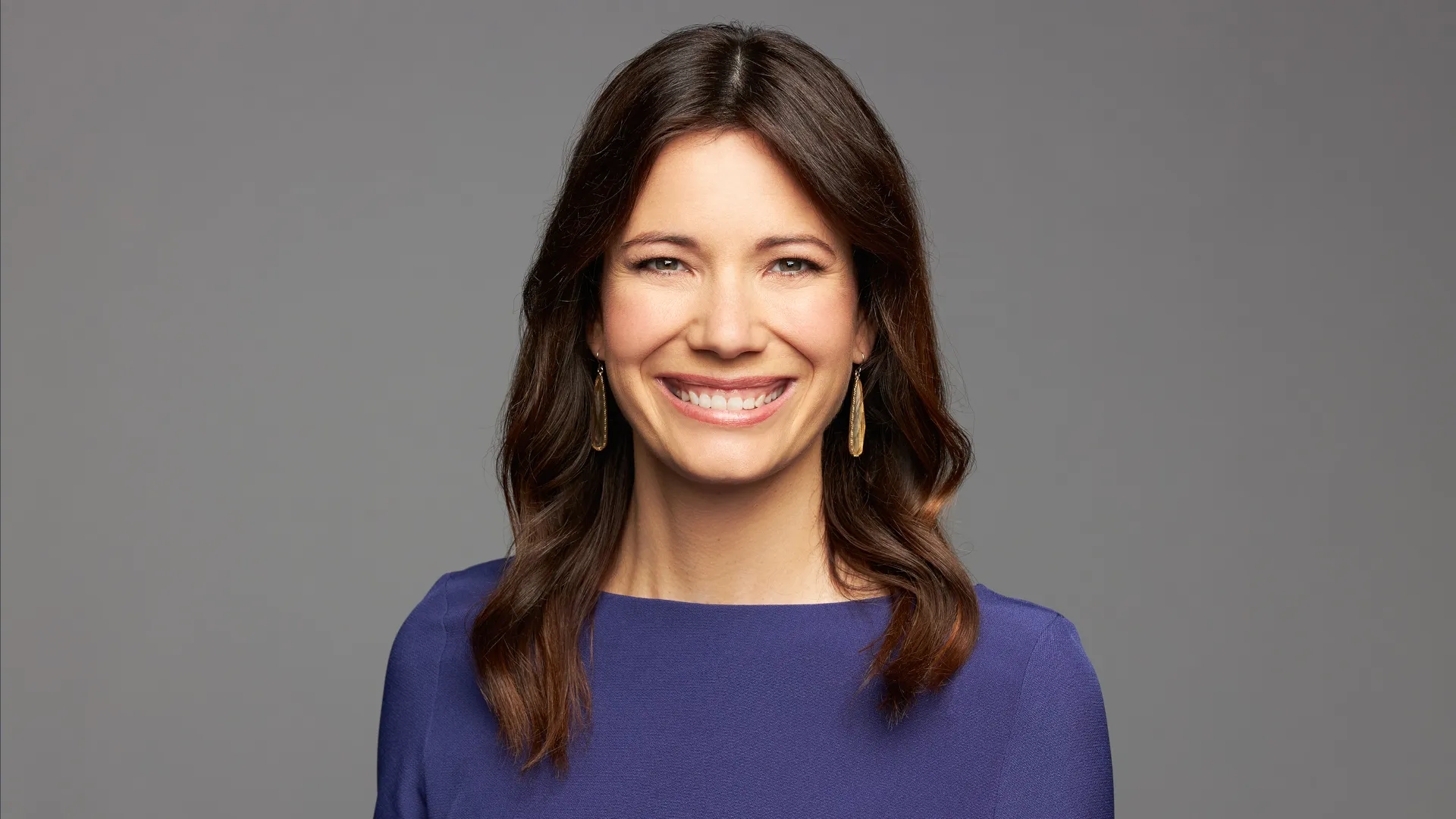

Biography:

Bola Sokunbi is the founder and CEO of Clever Girl Finance, a personal finance platform dedicated to helping women take control of their money and build wealth.

Sokunbi’s own money journey was strongly influenced by her mother, who after getting married at the age of 19 and raising four young children, decided to go back to school to get her college degree and start several of her own businesses. This allowed her mother to contribute to their family finances and create financial security for herself. Sokunbi used the lessons she learned from her mother to save her first $100,000 in just under three years while earning a salary of $54,000.

Despite achieving this goal, Sokunbi admits she made many missteps along the way. She started Clever Girl Finance to help other women navigate their own money mistakes and to create a safe space for them to learn about money and financial wellness free of judgment.

Why She’s a Top Money Expert:

Sokunbi not only runs a popular personal finance platform supported by several writers and content creators, but she has the credentials to back it up — she is a Certified Financial Education Instructor (CFEI).

Q&A:

What’s the one piece of money advice you wish everyone would follow and why?

Don’t compare yourself to other people, especially not on social media. Comparison is the thief of joy. So many people get into debt trying to keep up with or impress others. What’s most important is focusing on ourselves and what we truly want to achieve in our own lives.

What’s the most important thing to do to build wealth?

Prioritize paying down high-interest debt and invest consistently over time. Even if you can only afford to invest small amounts of money, over time your investments will add up, especially due to compounding, appreciation and dividends.

What’s your best tip for fighting the impacts of inflation?

It’s important to budget and give every dollar you earn a job to do. Also, consider areas in your budget you can cut back on.

When shopping consider generic vs. brand names to save on costs.

Get creative to earn more income, e.g., a part-time job or side hustle, better-paying job, downsizing and selling items.

Look for opportunities to get high interest rates on the cash you have on hand at financial institutions to minimize inflation on your cash savings.

It’s also a good idea to pay off high-interest debt associated with credit cards with rates that may increase as a result of inflation.

What’s the biggest mistake people make when it comes to money, and what should they do instead?

One of the biggest mistakes people make is assuming they cannot achieve financial wellness. It starts with adjusting your mindset, setting the intentions, tying in goals that are measurable and taking actions. There may be setbacks and sometimes progress might seem slow, but over time, you’ll be surprised at how much you’ve been able to accomplish.

Top Offers

Money Advice From Experts