How To Find Your Bank Routing and Account Numbers on a Check

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

There are many reasons you might need to locate your bank account and routing numbers. You may need your bank account number to pay a bill online or over the phone, send money through a wire transfer or set up a direct deposit. To receive your tax refund via direct deposit, you must provide your bank’s routing number on your tax return.

If you need help locating these numbers, you’ve come to the right place. Read on to quickly learn where to find your bank routing and account numbers on a check. You’ll also discover alternative ways to find your account and routing numbers if you don’t have a paper check on hand.

Where Are the Account and Routing Number on a Check?

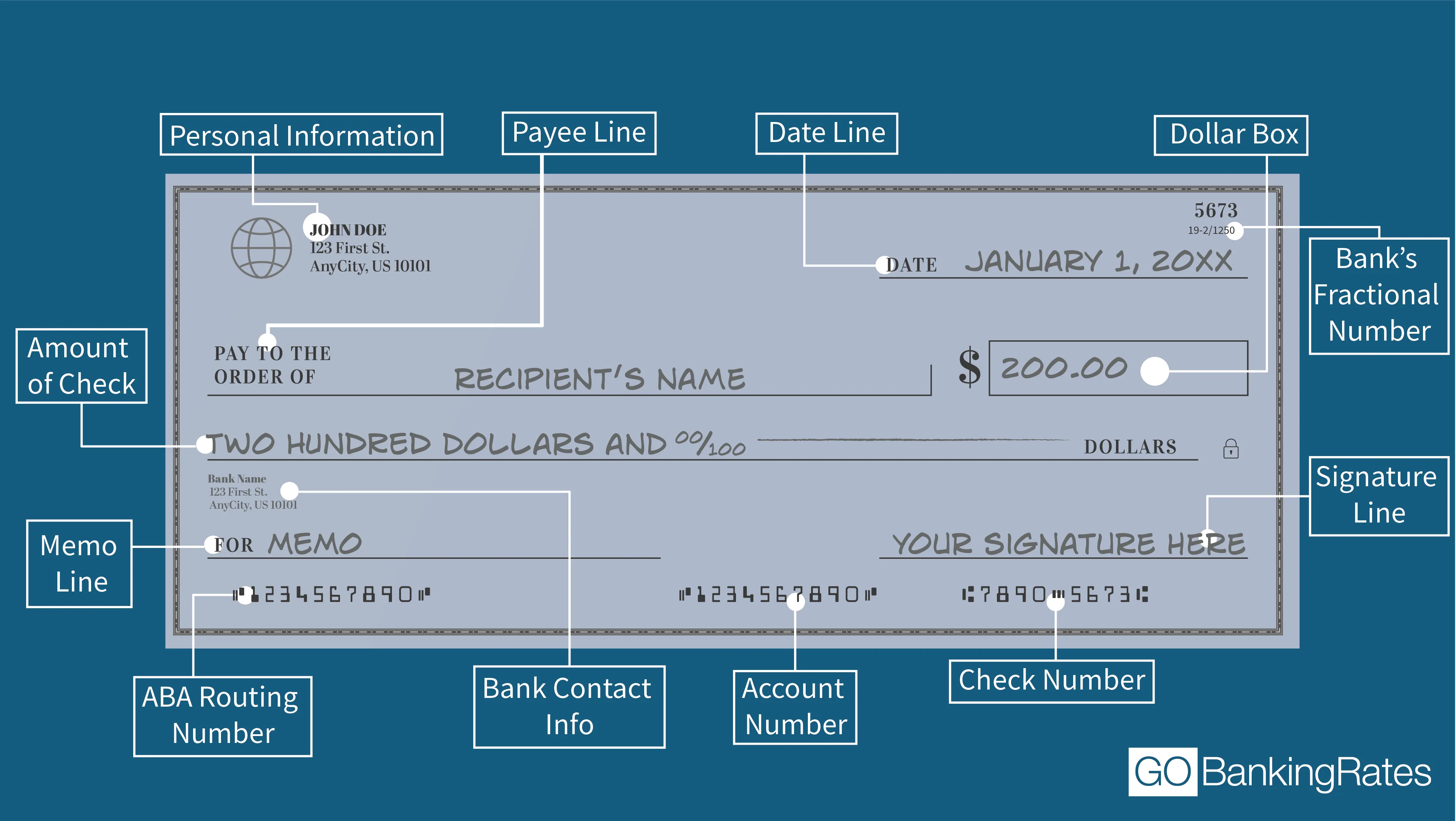

If you look at a bank-issued check, you’ll see a series of numbers printed along the bottom edge of the check. Here’s a quick explanation of what each of these numbers are and what they mean.

Bank Routing Number

Banks use routing numbers to process several types of transactions, including paper and digital checks, direct deposits and bill payments. The routing number is like an address identifying the bank or financial institution and its location. It’s based on the state where you opened your account.

Check routing numbers are always nine digits. They have a specific structure consisting of three parts: a four-digit Federal Reserve routing symbol, a four-digit American Bankers Association institution identifier and a single check digit. You might also hear routing numbers referred to as transit numbers.

To find your bank routing number on a check, locate the first series of numbers on the bottom left. This nine-digit string is your routing number.

When you make a payment using an electronic or paper method, the receiving bank uses the routing number to identify your bank. So whenever you’re asked to provide your routing number, you should ensure you use the correct one. Otherwise, the processing of your transaction could be delayed, especially since some banks have different routing numbers for each state.

Bank Account Number

While your bank routing number identifies your financial institution and its location, your bank account number identifies your personal account at that institution. It tells the bank where to withdraw or deposit money when making transactions.

Where is the account number on the check? It’s the second set of numbers along the bottom of your check, directly following the routing number. It may be longer or shorter than the routing number. Most bank account numbers are between eight and 12 digits, although yours could be as long as 17 digits.

Check Number

To the right of the account number is the check number, which will be different on each check. You can also find the check number located at the top-right corner of the check. The check number is primarily for your own benefit, to help you balance your checkbook and keep track of your checks and spending.

Alternative Ways To Find Your Bank Routing and Account Numbers

As an alternative to using a paper check to find your account and routing numbers, you can usually find these numbers on your bank account statement. Most banks include these numbers on both electronic and paper statements. You can often find them in the upper-right corner of your monthly statement, near the bank’s logo and other identifying information.

If you’re trying to locate your routing and account numbers without a check, you can also find them in your bank’s online banking platform or mobile app. Log into your account and click on an account to find the corresponding routing and account number.

Some financial institutions post their routing numbers on their website for reference. If you’re looking for your routing number on your bank’s website, remember to search by location as routing numbers often vary by state.

Final Take

If you have a checking account, it’s helpful to know how to locate you routing number on a check and how to differentiate it from your account number. If you don’t have paper checks, check a bank statement or your online bank account to find your account and routing numbers. The next time you’re asked to provide them when setting up an automatic deposit, an online bill payment or a similar transaction, you’ll know you’re using the correct numbers so transactions process correctly and without delays.

Andrea Norris contributed to the reporting for this article.

Information is accurate as of Nov. 28, 2023.

The article above was refined via automated technology and then fine-tuned and verified for accuracy by a member of our editorial team.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Written by

Written by  Edited by

Edited by